by Katy Grimes at californiaglobe.com

Even as California faces a record $68 billion budget deficit – after blowing a supposed $100 billion surplus last year – Gov. Gavin Newsom continues to lie about the state’s income taxes, claiming that they are not the highest in the country.

Notably, the $68 billion budget deficit does not include the state’s more than $1 trillion unfunded pension and health care liability for its retired government employees, or the massive debt California owes to the federal government for the EDD unemployment fraud during the COVID pandemic.

Not only are new taxes being imposed on January 1, 2024 to cover Newsom’s and Democrats’ deficit spending, Newsom claims that Florida “taxes low-income workers more than we tax millionaires and billionaires in the state of California.”

The Wall Street Journal cut to the chase and responded:

“How’s that possible when California imposes higher income, sales and gasoline taxes than Florida? California’s gas tax is 77.9 cents a gallon compared to 35.2 cents in Florida. The average state-and-local sales tax rate in California is 8.85% versus 7.02% in Florida.

In addition to soaking its rich, California imposes a 6% top marginal income tax rate on individuals earnings more than $37,789 and 9.3% over $66,296. Florida has no income tax.”

California’s overall tax burden on middle – and lower-income folks is higher than Florida’s.

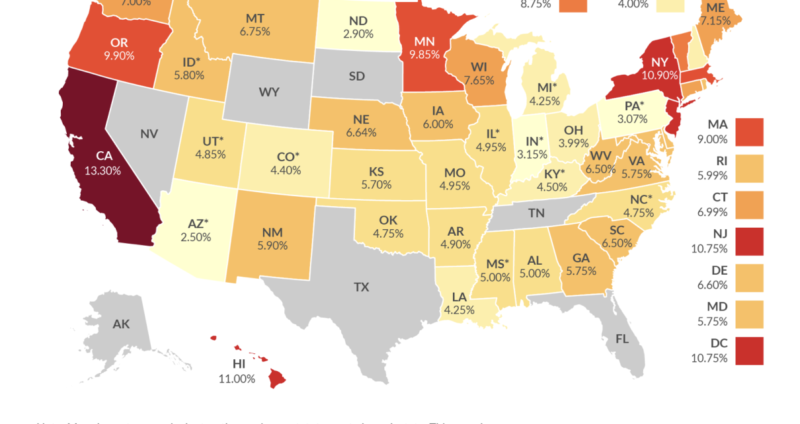

Here is the Tax Foundation’s proof, state by state: