by DAVID HAGGITH at thedailydoom.com

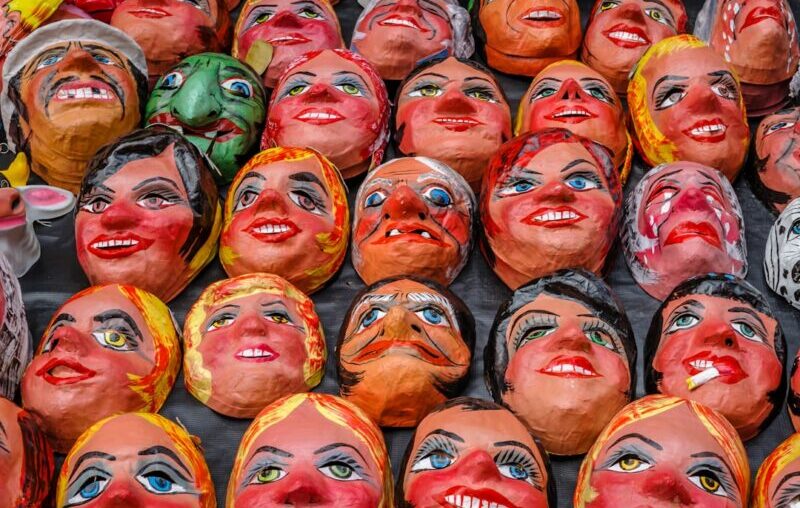

Central bankers, all bankers, the media, investors, congress and the masses, ALL keep playing the same bubble games over and over again.

And, so, the years and years of extreme financial manipulation began, and so they continue today.

The years since the Great Financial Crisis have been one giant and ridiculous ride that has attempted to deny reality in order to avoid the pain of making meaningful corrections in how our economy works, which has gone from major money printing in 2008 to bigger money printing in each subsequent numbered round of QE to the absolutely grandiose money printing necessary to save the economy during the insane Covid lockdowns that we needlessly created for ourselves.

Each round has had to be bigger and had to last longer with the Covid round being the most extreme of all the extremes. And, yet, people forget where this marathon roller coaster of money printing began back with the first quantitative easing in the 2008 crisis.

So, of course, history repeats itself because … WE NEVER LEARN!

It has developed into a mentality that now always believes the next round of massive money printing or cheap money is about to come and that actually wishes for enough economic trouble to force the Fed to get back to its business of artificially creating markets so that investors don’t even have to worry about business fundamentals because they know the bottomless Fed funds will have to go somewhere and that will always be into financial assets.

However, the bubble mania in bonds is breaking already due to returning inflation, and the bubble baloney in stocks is starting to stink past its sell-by date. Two articles today ask if the outrageous stock bubble is getting ready to implode. One of them even says the latest crazed bull rally may go down as the shortest bull market in history. The biggest hysterical surges do come before the biggest crashes, especially when the surge is built out of nothing but hot air and hope. (These articles are highlighted in bold below, and I’ll let them make their own interesting cases.)

Worse than that! Today’s traders don’t even care if the company makes money! They sometimes don’t even seem to care if it ever will. I’ve said in the past that stocks have become mere chips for the rich to gamble with in the casino (placeholders as it were, empty of intrinsic value but traded as if they have value) where investors are just speculating on the flow of Fed funds. Which stock will the money pour into? Or as one of my long-time patrons put it, perhaps in better terms, they have become non-fungible tokens (NFTs) where the bet is not on the value of the company, but just on how many people will pile in.

As he wrote in a note to me,

The Fortune 500 companies are doing horrible, laying off, yet the stocks are all doing well (for now). Think of every stock like an NFT. Tesla is the board apes yacht club, and dollar rent a car is like toenail clowns—The community of believers has replaced fundamentals—for now.