by TYLER DURDEN at zerohedge.com

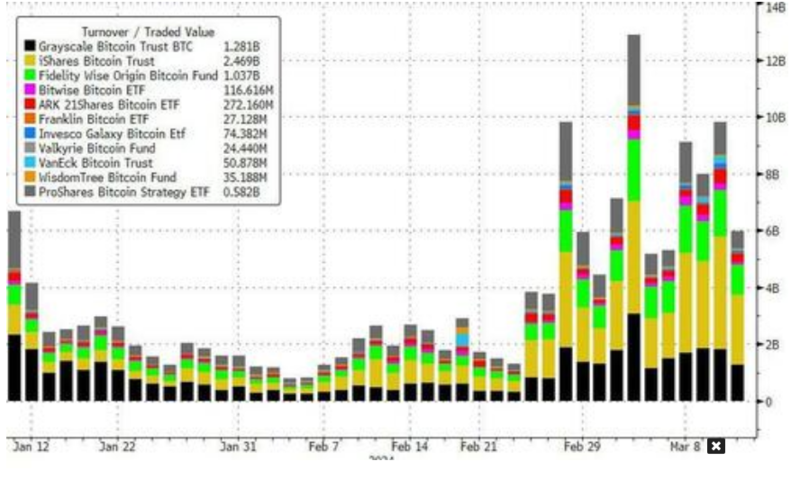

For the 9th straight day (and 15th of the last 16), Bitcoin ETFs saw net inflows yesterday…

…lifting the total net inflow of assets to $12BN in 44 trading days…

The unprecedented success of these new investment vehicles in democratizing access to an alternative currency (away from the manipulative money-printing largesse of bigger and bigger government) is apparently pissing Democrats off.

And so, having seen Senator Warren fail in her constant pressure efforts to stop SEC Chair Gary Gensler approving Bitcoiin ETFs, two Democrat Senators are urging the SEC to block any further crypto exchange-traded products (ETPs) to protect retail investors from risks associated with poor broker disclosure and thin liquidity in major cryptocurrencies.

As CoinDesk reports, Sen. Jack Reed (D-R.I.) and Sen. Laphonza Butler (D-CA) write that a FINRA survey disclosed that 70% of brokers’ communications with retail investors violated fair disclosure rules.

“Brokers’ communications falsely equated cryptocurrency with cash; in others, they provided misleading explanations of cryptocurrency’s risks,” they wrote.

“These alarming deficiencies raise significant concerns that brokers and advisers may now provide incomplete and deceptive information about bitcoin ETPs to retail investors.”